5 Best Cryptocurrency Trading Platform in 2024

Cryptocurrency trading platforms are online portals that allow users to buy, sell, and exchange digital currencies. These platforms provide a marketplace where traders can execute orders and participate in various trading activities, such as spot trading, futures trading, and margin trading. In this Article we tried our level best to help you in understanding 5 best cryptocurrency trading platform and you can clearly take decision as per your requirements.

1.Binance

Binance provides a range of futures trading options, including perpetual and quarterly futures, settled in either USDT, BUSD, or the underlying cryptocurrency. With over 600 futures markets available, traders can access a diverse selection, including popular cryptocurrencies like Bitcoin, XRP, Dogecoin, BNB, Ethereum, Solana, and Cardano. Notably, Bitcoin is the most well known future market, as you’ll get leverage of up to 125x.

Binance provides a comprehensive suite of trading tools, including real-time order books, customizable charts, and seamless integration with TradingView. Moreover, Binance offers a dedicated mobile app for both iOS and Android users, ensuring accessibility on the go. Notably, Binance supports automated trading bots, allowing users to execute pre-defined strategies with ease. With Binance being the largest cryptocurrency exchange by trading volume, users benefit from access to premium liquidity, enhancing trading opportunities and efficiency.

For altcoins, Binance imposes smaller limits, similar to other platforms. Additionally, Binance offers crypto options, spot trading markets, and DeFi tools such as staking and yield farming. In terms of fees, Binance applies a 0.05% charge on futures positions, which can decrease based on trading volumes or when settling fees in BNB, the platform’s native cryptocurrency. Renowned for its advanced trading platform, Binance remains a popular choice among traders seeking robust trading features and opportunities.

Pros:

- Wide Range of Cryptocurrencies: Binance offers an extensive selection of cryptocurrencies for trading, including major coins like Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP), as well as a vast array of altcoins and tokens.

- High Liquidity: Binance boasts high liquidity across its trading pairs, facilitating smooth execution of trades at competitive prices, even for large orders.

- Low Trading Fees: Binance is known for its relatively low trading fees compared to other exchanges, with fees further reduced for users holding its native cryptocurrency, Binance Coin (BNB).

- User-Friendly Interface: The platform features an intuitive and user-friendly interface, suitable for both new and experienced traders. Binance offers multiple trading options, including spot trading, futures trading, margin trading, and more.

- Security Measures: Binance prioritizes the security of its users’ funds and personal information, implementing robust security measures such as two-factor authentication (2FA), cold storage for the majority of funds, and regular security audits.

- Mobile App: Binance provides a mobile app for iOS and Android devices, allowing users to trade and manage their portfolios on the go conveniently.

- Staking and Savings Options: Binance offers various staking and savings options, allowing users to earn passive income by staking certain cryptocurrencies or participating in savings programs.

- Global Availability: Binance serves users from around the world, with support for multiple languages and fiat currencies, making it accessible to a diverse range of traders.

Cons:

- Regulatory Uncertainty: Like many cryptocurrency exchanges, Binance faces regulatory challenges and uncertainties in various jurisdictions, which could impact its operations and services in the future.

- Customer Support: Despite efforts to improve customer support, some users have reported delays or difficulties in receiving timely assistance from Binance’s support team during periods of high demand.

- Complexity for Beginners: While Binance offers a user-friendly interface, the platform’s advanced trading features and financial products may be overwhelming for beginners, requiring a learning curve to fully understand.

- Risk of Hacks: While Binance has a strong track record of security, no exchange is immune to cyberattacks. There have been instances of security breaches and attempted hacks on Binance in the past, highlighting the ongoing risk of storing funds on centralized exchanges.

- Limited Fiat Support: While Binance supports a wide range of cryptocurrencies, its support for fiat currencies may be limited in some regions, making it less convenient for users to deposit or withdraw fiat funds.

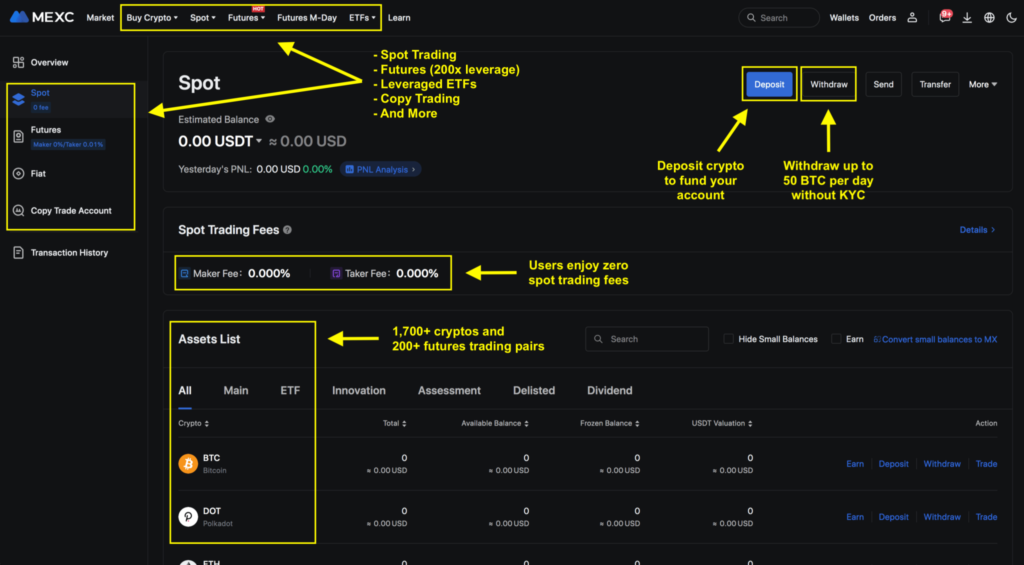

2. MEXC

MEXC, also known as MEXC Global, is a well-established cryptocurrency trading platform that offers a wide range of trading services to users around the world. Founded in 2018, MEXC has become one of the leading exchanges in the digital asset market, offering a user-friendly interface, advanced trading features, and a diverse selection of cryptocurrencies for trading.

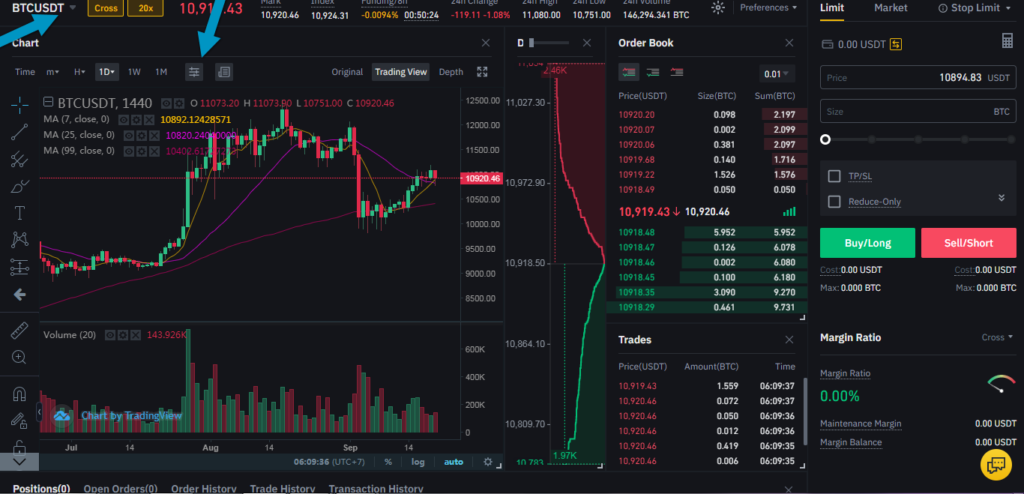

MEXC is one of the best choice for crypto trading with futures. Specializing in perpetual futures, MEXC offers a unique advantage with no expiry date, catering to both short-term and long-term traders. These perpetual futures come in two variants: one backed by USDT and the other settled in the underlying cryptocurrency. MEXC provides low trading fees, with a rate of only 0.02% for futures trading, applicable upon both opening and closing positions. MEXC is capable of processing up to 1.4 million positions per second. MEXC is having maximum leverage limit up to 200x.

Similar to other trading platform, MEXC supports a wide range of altcoins, including Polygon, Solana, Ethereum, Ripple, ApeCoin, BNB, Cosmos, and many others. This extensive selection complements offerings like Bitcoin, which boasts the highest leverage limit of 200x. However, it’s worth noting that MEXC does not currently support options trading, which may be a limitation for some users. The MEXC trading platform is combined with TradingView, providing users access to advanced charts, drawing tools, and technical indicators. Additionally, MEXC offers a dedicated mobile app for both iOS and Android devices, ensuring convenient access to trading on the go.

Pros:

- Wide Range of Altcoins: MEXC supports a diverse selection of altcoins, providing users with plenty of opportunities to trade and invest in lesser-known cryptocurrencies beyond the mainstream options.

- User-Friendly Interface: MEXC offers an immediate and easy-to-navigate interface, making it accessible to traders of all experience levels.

- Security Measures: MEXC prioritizes the security of user funds and personal information, implementing advanced security measures such as two-factor authentication (2FA) and cold storage for the majority of funds.

- Leverage Trading: MEXC provides leverage trading options for certain cryptocurrencies, allowing traders to boost their trading positions and potentially increase their profits.

- Responsive Customer Support: MEXC offers responsive customer support via email, live chat, and social media channels, ensuring timely assistance for users inquiries and issues.

Cons:

- Limited Fiat Currency Support: MEXC may have limited support for fiat currencies compared to other exchanges, which could inconvenience users looking to deposit or withdraw fiat funds.

- Lack of Options Trading: MEXC does not currently support options trading, limiting the variety of trading strategies available to users.

- Variable Fees: While MEXC’s trading fees are generally competitive, they may vary depending on factors such as trading volume and cryptocurrency pairs, potentially leading to higher costs for certain transactions.

3. PrimeXBT

Launched in 2018, PrimeXBT has quickly gained popularity among both novice and experienced traders due to its innovative features, competitive fees, and user-friendly interface. PrimeXBT allows users to trade crypto-based perpetual contracts, enabling them to speculate on the price movements of various cryptocurrencies without an expiry date.

The PrimeXBT offers low trading fees, making it cost-effective for traders to execute trades and manage their portfolios. PrimeXBT imposes a maker/taker fee of 0.01%/0.02%, ensuring competitive pricing for users. With PrimeXBT, traders can access a diverse selection of assets, including over 40 leading cryptocurrencies and altcoins. PrimeXBT provides traders with the option to apply high leverage on futures trades, allowing them to amplify their positions and potentially increase their profits. Users can access leverage of up to 100x on certain trading pairs.

Prior taking out futures contracts, you can analyze the markets by leveraging the advanced charts and trading tools at PrimeXBT’s disposal. Other best features of this platform includes Copy Trading – a tool through which you can copy the exact trades of other skilled traders.

Along with a Laptop or Desktop, PrimeXTB can be accessed through its mobile application – available on iOS and Android.

Pros:

- Diverse Range of Assets: PrimeXBT offers access to over 40 leading cryptocurrencies and altcoins, providing users with plenty of opportunities to diversify their portfolios and explore new trading options.

- Low Trading Fees: The platform imposes competitive trading fees, with a maker/taker fee of 0.01%/0.02%, making it cost-effective for traders to execute trades and manage their investments.

- High Leverage Options: PrimeXBT allows traders to apply high leverage on futures trades, with leverage of up to 100x available on certain trading pairs. This enables traders to amplify their positions and potentially increase their profits.

- Isolated Margin: PrimeXBT offers isolated margin types, allowing traders to adjust margin settings according to their risk tolerance and trading strategies. This feature provides flexibility and control over trading positions.

- Integration with TradingView: PrimeXBT seamlessly integrates with TradingView, a popular charting platform, providing users with advanced charting tools, technical indicators, and customizable trading strategies for in-depth market analysis.

- Mobile App: PrimeXBT offers a native mobile application for both iOS and Android devices, allowing users to trade on the go and stay updated with market developments anytime, anywhere.

- Copy Trading: PrimeXBT features Copy Trading, a tool that enables users to replicate the trades of skilled traders automatically. This feature allows inexperienced traders to learn from experts and potentially improve their trading performance.

Cons:

- Limited Fiat Support: PrimeXBT may have limited support for fiat currencies compared to other exchanges, which could inconvenience users looking to deposit or withdraw fiat funds.

- Risk of High Leverage: While high leverage can amplify profits, it also increases the risk of significant losses. Traders should exercise caution and proper risk management when using leverage on PrimeXBT.

- No Options Trading: PrimeXBT does not currently support options trading, limiting the variety of trading strategies available to users.

4. OKX

Founded in 2017, OKX is a leading cryptocurrency exchange platform that offers a wide range of trading services and financial products to users worldwide. OKX specializes in delivery futures contracts, which come with a predetermined expiry date. These contracts allow traders to speculate on the future price movements of various cryptocurrencies, including Bitcoin, Ethereum, Dogecoin, Solana, Polygon, Aave, and Arbitrum.

The maximum leverage limit when trading futures is 100x. However, this is reduced to 20x when trading in ‘full liquidation’ mode. In addition, OKX also offers perpetual futures and options. OKX charges competitive fees for trading services, with a fee of 0.05% per transaction for futures trading, in line with industry standards. Options trading fees are set at 0.03% of the contract value, making it cost-effective for users to execute trades.

OKX offers provide additional features, including a decentralized exchange (DEX) and wallet, crypto savings accounts, and loan services.

Pros:

- Wide Range of Cryptocurrencies: OKX offers a diverse selection of cryptocurrencies for trading, including popular assets like Bitcoin, Ethereum, Dogecoin, Solana, Polygon, Aave, and Arbitrum, providing users with sufficient trading opportunities.

- Specialization in Delivery Futures: OKX specializes in delivery futures contracts, allowing traders to speculate on the future price movements of cryptocurrencies with predetermined expiry dates, providing clarity and transparency in trading.

- Leverage Trading Options: Traders on OKX can utilize leverage trading options, with a maximum leverage limit of 100x for futures trading, enabling them to raise their positions and potentially increase their profits.

- Perpetual Futures Contracts: In addition to delivery futures, OKX also offers perpetual futures contracts, which do not have an expiry date, providing users with continuous trading opportunities and flexibility in managing their positions.

- Options Trading Services: OKX provides options trading services for select cryptocurrencies, including Bitcoin and Ethereum, enabling traders to hedge their positions or speculate on future price movements with defined risk.

- Competitive Fees: OKX charges competitive fees for trading services, with a fee of 0.05% per transaction for futures trading and 0.03% of the contract value for options trading, making it cost-effective for users to execute trades.

- Additional Features: OKX offers a range of additional features, including a decentralized exchange (DEX) and wallet, crypto savings accounts, and loan services, providing users with access to a comprehensive suite of financial products and services within the OKX ecosystem.

Cons:

- Limited Fiat Support: OKX may have limited support for fiat currencies compared to other exchanges, which could inconvenience users looking to deposit or withdraw fiat funds.

- Reduced Leverage in ‘Full Liquidation’ Mode: The maximum leverage limit of 100x for futures trading is reduced to 20x in ‘full liquidation’ mode, which may limit the trading capabilities of some users.

- Limited Options Trading Availability: OKX offers options trading services for only a select few cryptocurrencies, limiting the variety of trading options available to users compared to other platforms.

5. Kraken

Kraken is a prominent cryptocurrency exchange platform that has been operating since 2011. Founded by Jesse Powell, Kraken has become one of the most trusted and reliable exchanges in the cryptocurrency industry, offering a wide range of trading services to users worldwide. Kraken is renowned for its spot trading services, allowing users to buy, sell, and trade a variety of cryptocurrencies directly from the platform’s order book. With support for over 95 different cryptocurrencies, including major assets like Bitcoin (BTC) and Ethereum (ETH), as well as altcoins such as Algorand, Dogecoin, Aave, and Stellar, Kraken provides users with ample trading options.

In addition to spot trading, Kraken also offers futures markets, allowing users to trade perpetual futures contracts backed by US dollars. Futures trading on Kraken is conducted through the Kraken Pro platform, which comes equipped with a range of trading tools and features. This includes customizable charts, live order books, technical indicators, and various order types to suit different trading strategies.

Kraken offers leverage of up to 50x for futures trading, Kraken charges competitive trading fees, with a fee of 0.05% per transaction for futures trading. Commissions may be reduced as trading volumes increase, providing users with cost-effective trading options. Kraken also offers leveraged tokens, which are similar to futures contracts but with no liquidation risks. However, leveraged tokens are capped at 5x leverage, which may not be as appealing to some traders.

Pros:

- Established Reputation: Kraken is one of the oldest and most respected cryptocurrency exchanges in the industry, having been founded in 2011. Its long history and strong track record contribute to its reputation as a trustworthy platform.

- Wide Range of Cryptocurrencies: Kraken supports over 95 different cryptocurrencies, providing users with a diverse selection of assets to trade. This extensive offering allows users to access both major cryptocurrencies like Bitcoin and Ethereum, as well as a variety of altcoins.

- Futures Trading: Kraken offers futures trading markets, allowing users to trade perpetual futures contracts backed by US dollars. This feature enables traders to speculate on the future price movements of cryptocurrencies with leverage.

- Leverage Trading: With leverage of up to 50x available for futures trading. This feature can be beneficial for experienced traders seeking to maximize their returns.

- Kraken Pro Platform: The Kraken Pro platform offers a range of advanced trading tools and features, including customizable charts, live order books, and technical indicators. This enables users to conduct thorough market analysis and execute trades with accuracy.

- Competitive Fees: Kraken charges competitive trading fees, with a fee of 0.05% per transaction for futures trading. Additionally, commissions may be reduced as trading volumes increase, providing users with cost-effective trading options.

Cons:

- Limited Fiat Support: Kraken may have limited support for fiat currencies compared to other exchanges, which could inconvenience users looking to deposit or withdraw fiat funds.

- Complex Interface: Some users may find Kraken’s interface to be complex or overwhelming, especially for beginners who are new to cryptocurrency trading. The platform’s extensive features and advanced tools may require a learning curve for inexperienced traders.

- Leveraged Tokens Limitations: While Kraken offers leveraged tokens as an alternative to futures contracts, these tokens are capped at 5x leverage, which may not be as appealing to traders seeking higher leverage options.