Blue Chip Stocks At 52 Week Low- NSE 2024

Welcome to our guide on investing in blue chip stocks at their 52-week lows. In this article, we’ll explore the strategy behind investing in these blue chip stocks, known for their stability and potential for long-term growth. Discover how evaluating the 52-week low can help investors identify undervalued opportunities and make informed decisions. We’ll search the reasons investors prefer undervalued stocks and the limitations of blue chip stocks in generating short-term returns.

What are blue chip stocks?

Blue chip stocks are like the superheroes of the stock market! Think of them as the most reliable and trustworthy stocks out there. They come from companies that are doing really well financially and have a history of making solid profits. Plus, they often share their success with investors by paying out dividends regularly. That’s why they’re so popular among careful investors who like to play it safe with their investments.

| S.No. | Name | CMP Rs. | P/E | Market Capitalization Rs. Cr. | Dividend yield % | NP Qtr. Rs. Cr. | Sales Qtr. Rs. Cr. | ROCE% | 52w Low Rs. |

|---|---|---|---|---|---|---|---|---|---|

| 1. | HDFC Bank | 1519.60 | 18.02 | 1154426.54 | 1.28 | 18012.87 | 79433.61 | 9.50 | 1363.45 |

| 2. | Infosys | 1416.30 | 22.59 | 587887.36 | 2.68 | 7975.00 | 37923.00 | 39.99 | 1239.00 |

| 3. | ITC | 436.45 | 26.63 | 544895.67 | 2.92 | 5406.52 | 18019.37 | 39.01 | 399.30 |

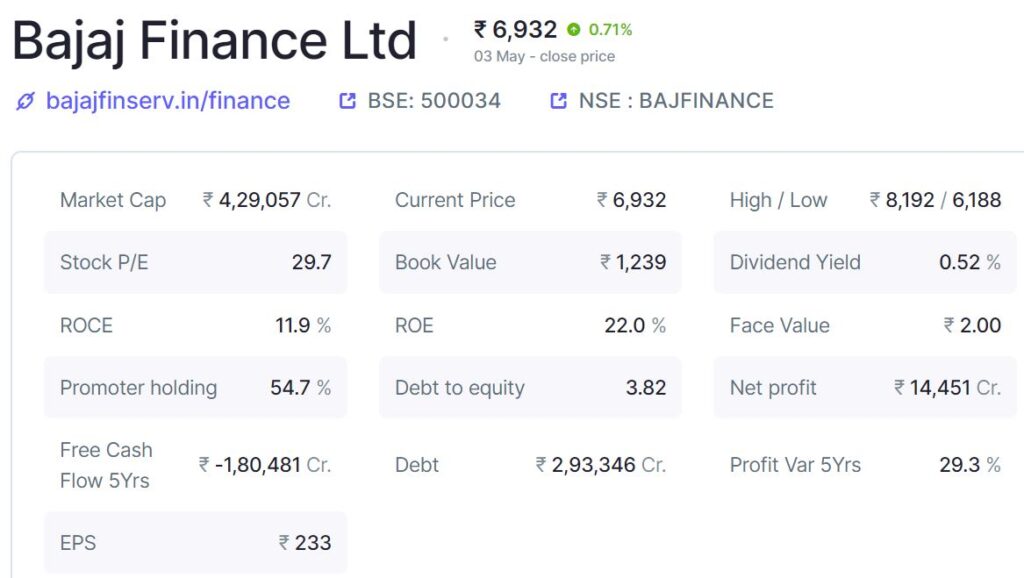

| 4. | Bajaj Finance | 6931.50 | 29.69 | 429057.30 | 0.52 | 3824.53 | 14926.21 | 11.87 | 6187.80 |

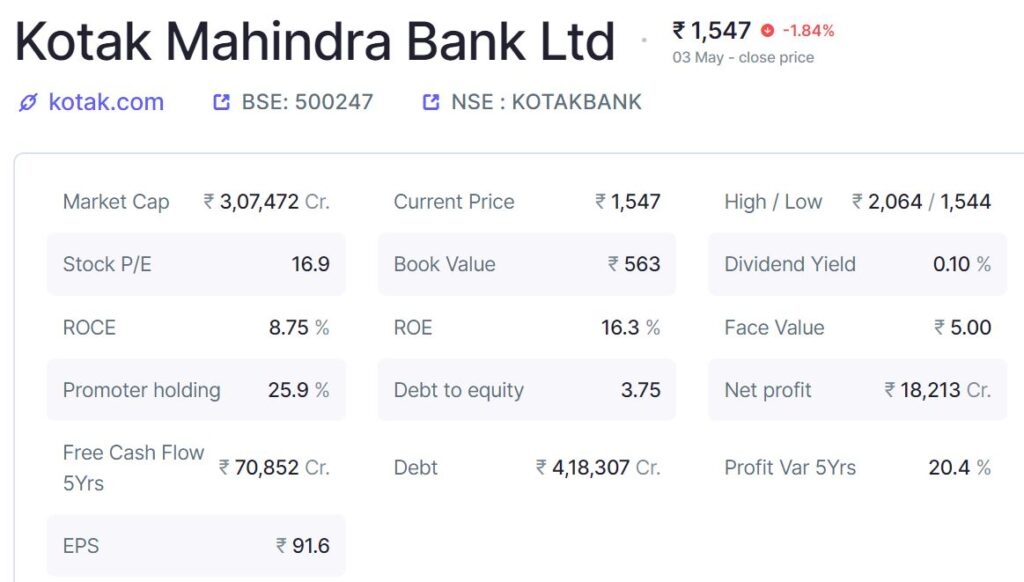

| 5. | Kotak Mahindra Bank | 1546.70 | 16.88 | 307471.73 | 0.10 | 5337.20 | 15156.18 | 8.75 | 1543.85 |

Details about 52-week low blue chip stocks

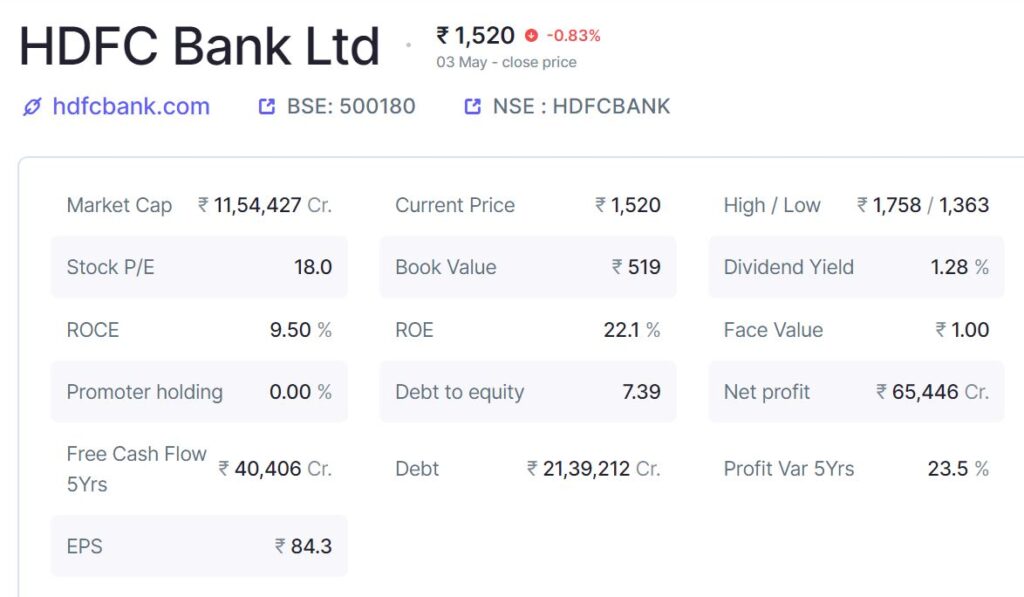

HDFC Bank Ltd

Established since 1994, HDFC Bank Ltd offering all sorts of banking services, from helping out big companies with their finances to everyday banking for regular people like you and me.

Now, when we talk about their stock performance, we’re looking at how their business has been doing over the past year. Overall, HDFC Bank has been doing pretty well. Their revenue, which they make from all their services, has been growing at a decent rate of around 15.32% over the last 5 years. That’s better than most other banks out there.

But when it comes to how much profit they’re making, it’s not growing quite as fast. Their net income, which is left after paying all their expenses, has been growing at about 19.98%, which is a bit lower than the industry average.

Looking as per Future perspective, people are hopeful about HDFC Bank’s stock. They think it’ll bring in good returns, even though the growth in revenue and profits might not be as high next year.

According to the Tickertape Scorecard, the stock is considered to be overpriced and is not showing strong financial growth. However, it still demonstrates average performance overall, with a noteworthy profitability rating of 7.9 out of 10.

There are no red flags in the stock, and it is overpriced but is not in the overbought zone.

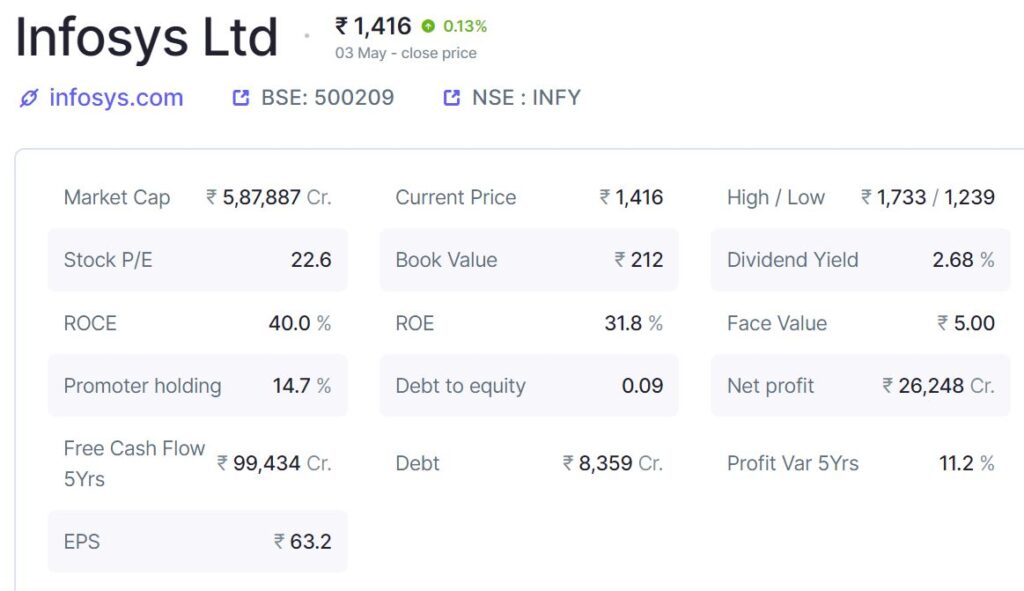

INFOSYS Ltd

Infosys, founded in 1981 in India, has become a global leader in technology and consulting services. With over 240,000 employees worldwide, Infosys serves clients in more than 50 countries.

In the fiscal year 2023-2024, Infosys reported a revenue of $14.5 billion, marking a 15% increase compared to the previous year. This impressive growth is a proof to their dedication to innovation and excellence.

Infosys is committed to sustainability and social responsibility. They’ve reduced their carbon footprint by 30% over the past five years and invested $100 million in renewable energy projects. Additionally, Infosys Foundation, their philanthropic arm, has impacted the lives of over 2 million people through various education and healthcare initiatives.

In terms of performance, Infosys consistently delivers excellent services to its clients, earning them a customer satisfaction rating of 92%. This high level of satisfaction reflects their commitment to quality and customer-centric approach.

Overall, Infosys is not just a tech giant; it’s a company with a heart, making waves in the tech world while also making a positive impact on society.

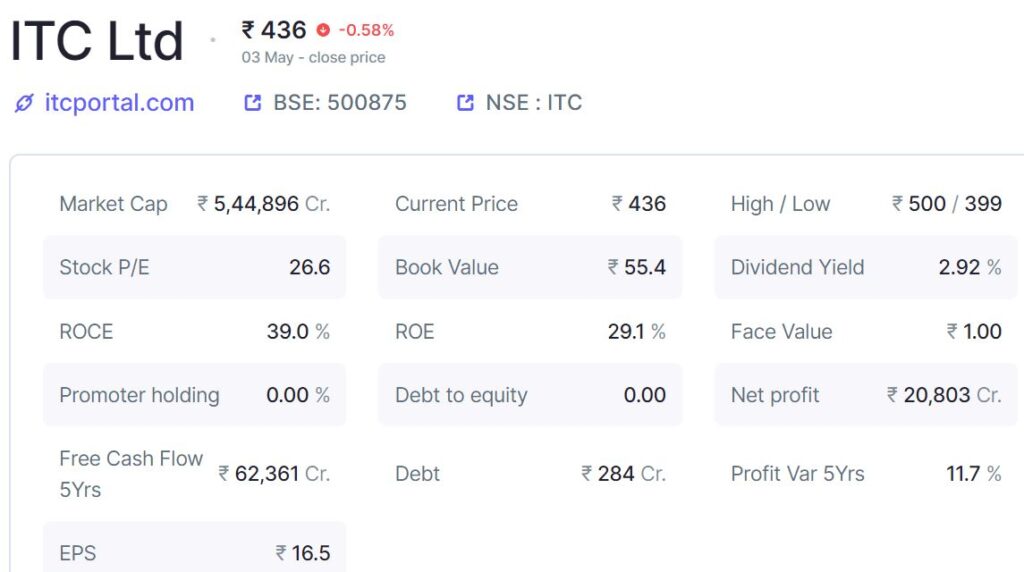

ITC Ltd.

Founded in 1910, ITC has grown into a diversified conglomerate with interests in various sectors including FMCG (Fast Moving Consumer Goods), hotels, agriculture, and paperboards.

In the fiscal year 2023-2024, ITC reported a revenue of $12.8 billion, showcasing its significant presence in the market. With over 25,000 employees, ITC operates across India and has expanded its footprint to international markets as well.

But ITC isn’t just about business; it’s also committed to sustainability and social responsibility. The company has invested heavily in renewable energy projects and has implemented various initiatives to reduce its environmental impact. Additionally, through its CSR (Corporate Social Responsibility) activities, ITC has positively impacted the lives of numerous communities across the country.

When it comes to performance, ITC has consistently show power and adaptability in the face of challenges. Despite fluctuations in market conditions, the company has maintained a strong market position and continues to innovate across its various business verticals.

Bajaj Finance Ltd.

Established in 1987, Bajaj Finance has emerged as one of the leading non-banking financial companies (NBFCs) in the country.

In the fiscal year 2023-2024, Bajaj Finance recorded a total income of $4.2 billion, reflecting its robust performance in the market. With a customer base of over 46 million, Bajaj Finance offers a wide range of financial products and services, including consumer loans, SME (Small and Medium Enterprises) loans, and wealth management solutions.

But Bajaj Finance also committed to driving financial inclusion and empowerment. Through its digital initiatives and innovative products, Bajaj Finance has played a significant role in expanding access to credit and financial services, particularly in rural and underserved areas.

Bajaj Finance has consistently delivered strong results, with a focus on careful risk management and customer-centric approach. Despite the challenging economic environment, the company has maintained healthy profitability and continues to explore new path for growth and expansion.

Kotak Mahindra Bank Ltd.

Kotak Mahindra Bank, a key player in India’s banking sector. Established in 1985, Kotak Mahindra Bank has grown into one of the leading private sector banks in the country.

In the fiscal year 2023-2024, Kotak Mahindra Bank reported a total income of $7.6 billion, showcasing its significant presence and strong performance in the market. With a wide network of branches and ATMs across India, Kotak Mahindra Bank serves millions of customers, offering a comprehensive range of banking and financial services.

But Kotak Mahindra Bank is technological initiatives and customer-centric approach, it has enhanced the banking experience for its customers, making banking more accessible and convenient. Kotak Mahindra Bank has consistently delivered solid results, with a focus on sustainable growth and risk management.

Importance of blue chip stocks in the stock market

Blue chip stocks play a vital role in the stock market by acting as indicators of the overall economic condition. They attend to reflect the trends of the wider market, making them essential for maintaining stability in investment portfolios. Opting for these stocks is often seen as a safer choice, particularly when the market is experiencing instability.

Understanding the significance of 52-week highs and lows The 52-week high and low points are key indicators of a stock’s price range over a year. A 52-week low marks the lowest price at which a stock has traded during this period, sparking various reactions among investors regarding its future potential.

Traders often pay close attention to stocks nearing their 52-week highs or lows. This is because they use these markers to determine optimal entry or exit points for trades. The 52-week high can act as a resistance level, while the 52-week low serves as a support level.

However, a stock may surpass its 52-week high and continue to rise, indicating a bullish market sentiment and trend continuation. This suggests that certain factors have pushed the stock price above its previous high, leading traders to believe that the upward momentum will persist, making it favorable to open new long positions.

Similarly, if a stock drops below its 52-week low, traders may consider selling or shorting the stock. However, betting on the future rise of such an undervalued stock can be risky.

ALSO READ: How to Invest in Stock Market for Beginners in 2024?

Factors contributing to 52-week lows

- Economic downturns: Economic downturns exert a significant influence on stock prices. During a recession or period of slowed economic growth, investor confidence wanes, leading to reduced spending and corporate earnings. Consequently, stock prices may plummet as investors withdraw from the market, resulting in stocks hitting their 52-week lows.

- Industry-specific challenges: Stocks may hit 52-week lows due to challenges unique to their industry. For instance, rapid technological advancements can render products or services obsolete. Moreover, regulatory changes can increase operational costs or reshape the market landscape, impacting stock values.

- Company-specific issues: Company-specific issues, such as poor earnings or management controversies, can profoundly impact stock prices. Persistent underperformance or instances of scandals, leadership instability, or operational inefficiencies may erode investor confidence, triggering declines in stock price.

- Market sentiment: Investor psychology and market sentiment play a significant role in stock market fluctuations. Negative news or pessimistic forecasts can trigger sell-offs, irrespective of a company’s underlying fundamentals. Media reports and analyst assessments can sway investor sentiment, driving stocks to their 52-week lows.

- External factors: Geopolitical events or shifts in global market dynamics can lead to stocks hitting 52-week lows. Events like conflicts, trade tensions, or changes in international policies introduce uncertainty, prompting adverse reactions from investors.

How to invest in blue chip stocks at 52-week low (NSE)?

- Navigate to Screener.in: Go to the Screener.in website and log in to your account. If you don’t have an account, you can sign up for free.

- Access the Stock Screener: Once logged in, locate the “Stock Screener” tab on the top menu and click on it to access the screener tool.

- Set Filters: In the stock screener, you’ll see various filter options on the left-hand side. Look for the “52 Week Low” filter, which should be under the “Price” section or a similar category.

- Select Criteria: Click on the “52 Week Low” filter to set your criteria. You can specify the range of 52-week lows you’re interested in, such as stocks trading within 5% or 10% of their 52-week lows.

- Add Additional Filters (Optional): You can further refine your search by adding additional filters based on your investment preferences. For example, you can filter by market capitalization, sector, or financial ratios.

- View Results: After setting your filters, click on the “Apply Filters” or “Run Screener” button to view the results. Screener.in will display a list of stocks that meet your specified criteria, including blue chip stocks trading at their 52-week lows.

- Review and Analyze: Review the list of stocks generated by the screener and analyze each stock’s fundamentals, financials, and other relevant information to identify potential investment opportunities.

Conclusion

Buying blue chip stocks when they’re at their lowest prices in a year can be a smart move. By doing your homework and picking solid companies, you might get good returns over time. Just remember to spread out your investments, be patient, and keep an eye on what’s happening in the market.

Disclaimer: The information provided in this article is for educational and informational purposes only. It should not be construed as financial advice or a recommendation to buy, sell, or hold any investment. Investing in stocks involves risk, including the potential loss of principal. Before making any investment decisions, it is essential to conduct thorough research and consult with a qualified financial advisor.

FAQs

1. Is it advisable to buy 52-week low shares for a long time?

Seeing stocks hit 52-week lows can be tempting for long-term investors, but it’s important to be cautious. While the lower price might indicate a buying opportunity if the company’s fundamentals are solid, there’s no guarantee the price will bounce back. Before investing, research why the stock is low in the first place. Remember, long-term investing is about strong companies and a diversified portfolio. Be patient, these are plays for the future.

2. When is it good to buy a 52-week low company stock?

Investing in a company’s stock when it’s at its 52-week low involves taking a risk. It’s a decision made with the belief that the company has the potential to rebound and reach new heights in the future. Simply buying because the price is lower isn’t enough; it’s crucial to assess the company’s future prospects before making a decision. Analyzing the company’s future outlook can provide valuable insight into whether purchasing the stock is a wise choice.

3. How can I easily find stocks that are trading near to their 52-week low?

Financial Websites: Many financial websites offer stock screeners with filters specifically for “Near 52-Week Lows” or “52-Week Low.” Examples include Tickertape and Screener.in. These websites allow you to quickly see a list of potential candidates.

Stock Brokers: Many stockbrokers also have built-in screening tools on their platforms. You can use these tools to filter for stocks based on various criteria, including proximity to their 52-week low.

4. Why is a 52-week low significant for blue chip stocks?

The 52-week low is a key indicator for blue chip stocks as it may signal an undervaluation or a temporary decline in an otherwise stable and profitable company. For investors, this can present a strategic buying opportunity, especially if the fundamentals of the company remain strong.

5. What strategies should be adopted when investing in blue chip stocks at their 52-week lows, particularly in India?

When investing in 52-week low blue chip stocks in India, it’s important to analyse the reasons behind the low prices, assess the long-term growth potential, and understand market trends. Diversifying investments and setting a long-term perspective are also crucial strategies for mitigating risk.

6. What makes a blue chip stock in India undervalued?

An undervalued blue chip stock in India is one whose market price is considered lower than its intrinsic value. Factors such as market fluctuations, temporary setbacks, or overall economic downturns can lead to undervaluation, presenting potential investment opportunities.