10 Best Ways To Boost Your Financial IQ

In today’s fast-paced world, financial literacy is more important than ever. Whether you’re managing personal finances, investing in the stock market, or planning for retirement, a strong financial IQ can help you make informed decisions and secure your financial future. Unfortunately, many people struggle with financial concepts, leading to poor financial choices and unnecessary stress. In this blog we will explore the ten best ways to boost your financial IQ, offering practical strategies and insights that are easy to understand and implement. By the end of this blog, you’ll be filled with the knowledge and tools to take control of your finances and build a more secure and prosperous future. Before we go further, we have to know What is Financial IQ?

What is Financial IQ?

Financial IQ, or Financial Intelligence, is the ability to understand and manage your money well. It includes skills like budgeting, saving, investing, understanding taxes, and managing debt. Having a high financial IQ means you can make smart financial choices that help you achieve stability and grow your wealth.

Importance of Financial IQ:

- Better Financial Decisions: A high financial IQ enables you to make well-informed decisions about spending, saving, and investing.

- Financial Independence: With a strong understanding of financial principles, you can work towards financial independence and freedom.

- Stress Reduction: Managing your finances effectively reduces financial stress and anxiety.

- Preparedness for Emergencies: Being financially literate helps you build an emergency fund and be prepared for unexpected expenses.

- Long-term Security: A high financial IQ contributes to long-term financial security, ensuring you are well-prepared for retirement and other future financial needs.

Here are 10 Best Ways To Boost Your Financial IQ:

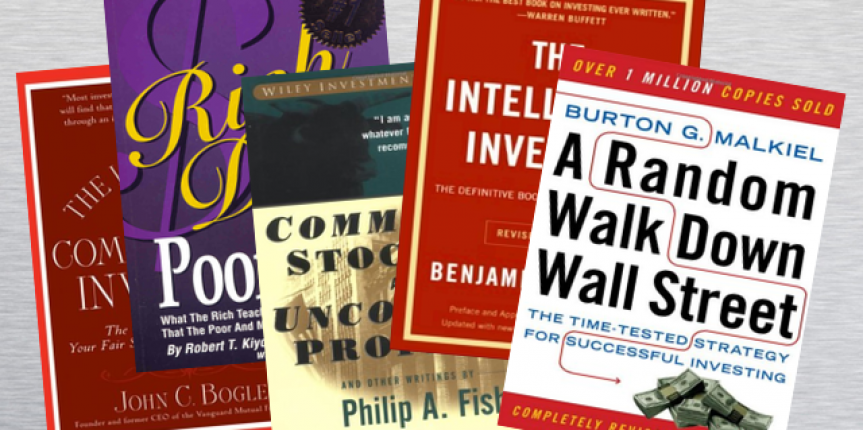

1. Educate Yourself with Books and Online Resources

Read good books about business and investing, consume good media on the matter, like podcasts and documentaries, and talk to people who are experts or have been successful financially. To boost your financial IQ, start by busy yourself in the wealth of educational resources available. Knowledge is power, and in the world of finance, it’s crucial to have a solid foundation.

Recommended Books:

- Rich Dad Poor Dad by Robert Kiyosaki: This book compares the financial philosophies of the author’s two “dads” – his biological father and his friend’s father, who influenced his understanding of money and investing. It teaches fundamental concepts like assets vs. liabilities, and the importance of financial education.

- The Total Money Makeover by Dave Ramsey: Ramsey’s book is a step-by-step guide to budgeting, getting out of debt, and building wealth. It emphasizes living below your means and being disciplined with your finances.

- The Intelligent Investor by Benjamin Graham: Considered the bible of investing, this book introduces the concept of value investing and provides insights into stock market strategies that can protect investors from substantial errors.

Online Resources:

- Websites: Investopedia and NerdWallet are excellent sources for financial definitions, tutorials, and calculators.

- Online Courses: Platforms like Coursera, Udemy, and Khan Academy offer courses ranging from basic personal finance to advanced investment strategies.

- Podcasts and YouTube Channels: These are great for learning on the go. Channels like Graham Stephan’s and podcasts like “The Dave Ramsey Show” provide practical advice and real-world examples.

ALSO READ: Stock Market Books: Every Investor Must Read Before investing!

2. Follow Financial News and Stay Updated

Keeping up with financial news is important because it helps you understand the economy and how it affects your money. It also keeps you updated on market trends, new financial products, and changes in laws and regulations. There’s also a lot of great websites and social media accounts dedicated to all kinds of financial topics. This exposure will help sharpen your financial education.

Reliable Sources:

- The Wall Street Journal and Financial Times: These newspapers provide in-depth analysis of financial markets, companies, and economic policies.

- Business News Channels: Channels like CNBC and Bloomberg offer real-time financial news and expert analysis.

- Financial Websites: MarketWatch and Yahoo Finance offer news, data, and analysis on stocks, mutual funds, and economic indicators.

3. Create and Stick to a Budget

Budgeting is like a map for your money, guiding you towards financial success. It helps you take control of your spending, save money smartly, and reach your financial goals. By making a budget, you get a clear picture of where your money goes every month. This knowledge lets you make smart choices about how you spend your money, preventing you from spending too much. Plus, budgeting lets you set aside money for important things, like emergencies or big dreams such as buying a house or going on a trip. Overall, budgeting gives you the power to manage your money wisely and get closer to making your financial dreams come true.

Steps to Create a Budget:

- Track Your Spending: Use an app or a spreadsheet to record every expense for a month. Categorize them into essentials (like rent and groceries) and non-essentials (like dining out and entertainment).

- Categorize Expenses: Common categories include housing, utilities, transportation, groceries, dining out, entertainment, and savings.

- Set Spending Limits: Based on your income and financial goals, allocate a specific amount to each category. Ensure you prioritize savings and debt repayment.

- Review and Adjust: At the end of each month, review your spending. Compare it with your budget, and adjust where necessary. Identify areas where you can cut back if you’ve overspent.

ALSO READ: 5 Best Free Budgeting Apps For 2024

4. Understand and Improve Your Credit Score

Having strong credit can give you more options and save you money in the long term. That’s because people with good credit scores typically get lower interest rates when they borrow money. Start by finding out your own credit score all of them—and then find out which steps make the most sense for you to improve your score. Finally, decide how and when to monitor your credit to make sure it’s not being used by someone else.

Ways to Improve Your Credit Score:

- Pay Bills on Time: Late payments can significantly hurt your credit score. Set up automatic payments or reminders to ensure you never miss a due date.

- Reduce Debt: Keep your credit card balances low relative to your credit limit. This is known as your credit utilization ratio, and a lower ratio can improve your score.

- Monitor Your Credit Report: Regularly check your credit report for errors. You can get a free report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year at AnnualCreditReport.com.

Tip: Use free credit monitoring services like Credit Karma, which provide regular updates on your credit score and suggest ways to improve it.

5. Invest in Stocks and Other Assets

Investing grows wealth over time by putting money into assets like stocks or bonds. Understanding basics, such as risk levels and diversification, helps make informed choices. Diversifying investments spreads risk, reducing impact if one investment performs poorly. Long-term patience is key, avoiding reacting to short-term market changes. Continuous education about investing keeps you informed and adaptable. By staying focused on goals and learning, you can increase chances of financial success.

Basic Investment Principles:

- Diversification: Spread your investments across different asset classes (stocks, bonds, real estate) and within asset classes (different sectors and geographies) to reduce risk.

- Risk Tolerance: Assess your risk tolerance based on your age, financial situation, and investment goals. Younger investors can typically take on more risk, while those nearing retirement should focus on preserving capital.

- Long-term Perspective: Successful investing requires a long-term approach. Avoid reacting to short-term market fluctuations and focus on your long-term financial goals.

ALSO READ: How to Invest in Stock Market for Beginners in 2024?

6. Learn About Taxation and Tax Planning

Understanding taxes and planning effectively are key to saving money and making smart financial choices. You need to know how taxes affect your income and investments. Taking advantage of deductions, credits, and incentives helps lower your tax bill. Strategies like putting money into retirement accounts and timing investments can also cut taxes. Keeping up with tax law changes helps you adjust your plan as needed. Ultimately, mastering tax planning helps you keep more money and reach your financial goals faster.

Tax Planning Strategies:

- Tax-Advantaged Accounts: Contribute to retirement accounts like 401(k)s and IRAs, which offer tax benefits. 401(k) contributions are often tax-deductible, and Roth IRA earnings grow tax-free.

- Deductions and Credits: Familiarize yourself with common deductions (like mortgage interest, student loan interest, and charitable donations) and credits (like the Earned Income Tax Credit and Child Tax Credit) that can reduce your taxable income.

- Capital Gains: Be mindful of the tax implications when selling investments. Long-term capital gains (for assets held more than a year) are typically taxed at a lower rate than short-term gains.

ALSO READ: Robo-Advisor Magic: The Easy Way to Cut Your Taxes!

7. Build an Emergency Fund

An emergency fund is like a financial safety blanket, ready to catch you when unexpected expenses arise. It prevents you from falling into debt by providing money for emergencies like medical bills or car repairs. With an emergency fund, you avoid relying on credit cards or loans, which can lead to high-interest debt. It brings peace of mind, knowing you’re prepared for life’s uncertainties. Building an emergency fund requires regular saving and discipline, but it’s worth it for the security it provides.

How to Build an Emergency Fund:

- Set a Savings Goal: Aim to save three to six months’ worth of living expenses. This can vary depending on your job security and personal circumstances.

- Automate Savings: Set up automatic transfers from your checking account to a dedicated savings account. This ensures consistent contributions and reduces the temptation to spend the money.

- Reduce Non-Essential Spending: Identify discretionary expenses that you can cut back on and redirect those funds to your emergency savings.

ALSO READ: 10 Easy Ways To Save Money From Salary

8. Understand Insurance and Its Importance

Insurance is essential for shielding yourself from financial problems caused by unexpected events. Knowing the types of insurance available ensures you choose the right coverage. Health insurance covers medical costs, auto insurance protects against vehicle damage, and homeowners or renters insurance safeguards your property. Life insurance provides for your loved ones after your passing, while disability insurance offers income if you’re unable to work due to illness or injury. By understanding insurance options, you can select the best protection for your needs, providing peace of mind against life’s uncertainties.

Types of Insurance to Consider:

- Health Insurance: Covers medical expenses, protecting you from the high costs of healthcare. It’s essential to have at least basic coverage to avoid financial strain due to medical emergencies.

- Auto Insurance: Mandatory in most states, it protects against financial loss from car accidents or theft. Ensure you have adequate coverage based on your needs and state requirements.

- Homeowners/Renters Insurance: Homeowners insurance covers damage to your home and personal belongings, while renters insurance covers your possessions in a rental property. Both provide liability coverage as well.

- Life Insurance: Provides financial support to your dependents in case of your untimely death. Term life insurance is often recommended for its simplicity and affordability.

- Disability Insurance: Offers income protection if you’re unable to work due to a disability. It’s particularly important for those in high-risk jobs or with significant financial responsibilities.

ALSO READ: Top 5 Life Insurance Companies in India: Your Guide to Financial Security

9. Plan for Retirement

Retirement planning is essential for ensuring financial stability in your later years. The earlier you start, the more time your money has to grow through compound interest.

Steps to Plan for Retirement:

- Determine Retirement Goals: Estimate how much money you’ll need in retirement based on your desired lifestyle, anticipated expenses, and longevity. Consider factors like travel, hobbies, and healthcare costs.

- Contribute to Retirement Accounts: Maximize contributions to employer-sponsored plans like 401(k)s, especially if your employer offers matching contributions. Also, consider individual retirement accounts (IRAs), which offer tax benefits.

- Diversify Investments: Ensure your retirement portfolio is well-diversified to balance risk and return. Include a mix of stocks, bonds, and other assets based on your risk tolerance and time horizon.

- Regularly Review Your Plan: Periodically review your retirement plan and adjust as needed to stay on track with your goals. Life events, changes in income, and market conditions may require adjustments.

ALSO READ: Plan your Retirement, Secure Your Future: A Step-by-Step Guide

10. WORK WITH A FINANCIAL ADVISOR

Creating a financial plan is important, but adjusting it as life changes happen can be challenging. Keeping track of retirement planning and changing tax laws can be overwhelming, almost like a full-time job for some. If managing your finances feels too much, you don’t have to do it alone. Think about getting help from a professional financial advisor. They stay updated on financial news and strategies, helping you adapt your plan as your life evolves.

When to Seek Professional Help:

- Complex Financial Situations: If you have multiple income streams, significant investments, or large debts, a financial advisor can help you manage them effectively.

- Major Life Changes: Events like marriage, divorce, the birth of a child, or retirement may require adjustments to your financial plan. An advisor can help you navigate these changes.

- Investment Guidance: Advisors can help you create and manage an investment portfolio that aligns with your risk tolerance and goals. They can provide insights into asset allocation, rebalancing, and tax-efficient investing.