Budget 2024 Updates: Tax Structure Unchanged, FM Highlights Achievements!

Finance Minister Nirmala Sitharaman presented the Interim Budget for FY-2024-25. This Budget will be the last one by the Modi government before the country heads 2024 General Elections.

Today, Finance Minister Nirmala Sitharaman presented the interim budget 2024. In her speech, she talked about how much the Indian economy has changed in the last ten years. She praised the Modi government for making big changes and helping people. She also said the government plans to keep working on reducing how much money it owes until it’s only 4.5% of what it spends by 2025-26. And when it comes to taxes, she mentioned that they won’t change. The government wants to keep the same tax rates for direct and indirect taxes, including import duties.

Budget 2024 Updates

February 01, 2024 10:27 AM

Interim Budget 2024: Important Figures to Monitor

Here are the crucial numbers to keep an eye on in the pre-election Budget for 2024-25:

- Fiscal Deficit: The planned fiscal deficit, which shows the gap between government spending and revenue, for the current fiscal year ending in March 2024 is 5.9 percent, compared to 6.4 percent in the previous fiscal year. All eyes will be on the figure for 2024-25 as it’s widely anticipated that the government will spend more in an election year.

- Disinvestment/Privatization: The target for disinvestment in the current fiscal year is expected to be missed, similar to the past five years. It’s anticipated that the government will set a realistic target of less than Rs 50,000 crore for the next fiscal year.

- Capital Expenditure: The government’s planned capital spending for this fiscal year is set at Rs 10 lakh crore, higher than the Rs 7.3 lakh crore in the previous fiscal year. The government has been focusing on building infrastructure and encouraging states to increase capital expenditure.

- Tax Revenue: The Budget projected direct and indirect tax collections to be Rs 18.23 lakh crore and Rs 15.29 lakh crore respectively for the current fiscal year, totaling Rs 33.61 lakh crore in gross tax collection. The government’s tax revenues are expected to exceed the budget estimates due to robust collections in GST, income tax, and corporate tax.

– PTI

February 01, 2024 10:37

Railway Stocks See rising Before Budget 2024 Presentation

Shares of companies associated with the railway sector were trading positively on Thursday morning ahead of the interim Budget presentation.

IRCON International saw a rise of 3.26 percent, Texmaco Rail & Engineering surged by 2.71 percent, Indian Railway Finance Corporation climbed 2.58 percent, and Rail Vikas Nigam advanced by 1.52 percent on the BSE.

Additionally, Jupiter Wagons’ stock increased by 1.46 percent, while Indian Railway Catering and Tourism Corporation (IRCTC) rose by 0.88 percent, and Titagarh Rail Systems showed a 0.71 percent uptick.

– PTI

FEBRUARY 01, 2024 11:03

How much the Indian economy has improved in the last 10 years.

In her speech before the election Budget 2024, known as an interim Budget, Sitharaman said that Indians are feeling hopeful about the future. She mentioned that under Prime Minister Narendra Modi, the government has been trying to include everyone in their plans. Sitharaman pointed out that thanks to changes in how things are done, programs for people, and more jobs, the economy is doing better.

After a tough year in 2020-21, the economy bounced back with a growth rate of 9.1% in 2021-22. According to the Finance Ministry, India could become the third-largest economy globally in the next three years, reaching $5 trillion from the current $3.7 trillion.

They also have a goal to make India a $7 trillion economy by 2030. In December, the Reserve Bank of India said the economy could grow by 7% this fiscal year, up from 6.5% before, because people are buying more things and factories are working harder. The International Monetary Fund (IMF) thinks India’s economy will grow by 6.5% in 2023-24 and 2024-25, which is higher than before. The World Bank and Asian Development Bank also think India’s economy will keep growing, predicting rates of 6.4% and 6.7% respectively for the next few years.

February 01, 2024 11:07

Boosting Development for Everyone

The government’s development plans aim to reach every household and person, providing essentials like housing, clean water, electricity, cooking gas, and banking services to all in record time. They’ve also ensured food security by giving free rations to 80 crore people and regularly increasing minimum prices for farmers’ produce. These efforts, according to Ms. Sitharaman, have led to higher incomes for rural areas.

February 01, 2024 11:11

‘Garib Kalyan, Desh ka Kalyan’: Finance Minister Talks about Schemes for the Poor

We’re focused on helping the poor. The old way didn’t really work. In the past 10 years, we’ve helped 25 crore people escape different kinds of poverty.

This has really made a difference in their lives. Through the PM Jan Dhan Yojana accounts, Rs. 34 lakh crore has been given directly to people, saving the government Rs. 2.7 lakh crore. This means more money can be used to help the poor.

Out of 78 lakh street vendors, 2.3 lakh have received credit for the third time under the PM Swanidhi Yojana.

February 01, 2024 11:14

Supporting the Youth: FM on Government Schemes for Young People

The National Education Policy 2020 is bringing about big changes. Through the Skill India Mission, 1.4 crore young people have been trained, with 54 lakh receiving additional skills and training, and 3,000 new ITIs have been established.

Many new universities have been opened, totaling 319.

Programs like Startup India and the Startup Credit Guarantee Scheme, along with a fund for funds, are helping young people find employment opportunities.

February 01, 2024 11:26

Master Plan for a Amrit Kaal

The Finance Minister announces that the government will implement economic policies aimed at promoting and sustaining growth, improving productivity, creating opportunities for everyone, and helping them increase their capabilities.

Following the principle of Reform, Perform, and Transform, the government will undertake next-generation reforms, she states.

Aligned with the Panchamrut goals, our government will focus on maintaining more efficient growth. To meet investment needs, we will develop a financial sector with scale, capacity, and regulatory frameworks.

Development of the East – Our government will give top priority to making the Eastern region and its people a powerful driver of India’s growth.

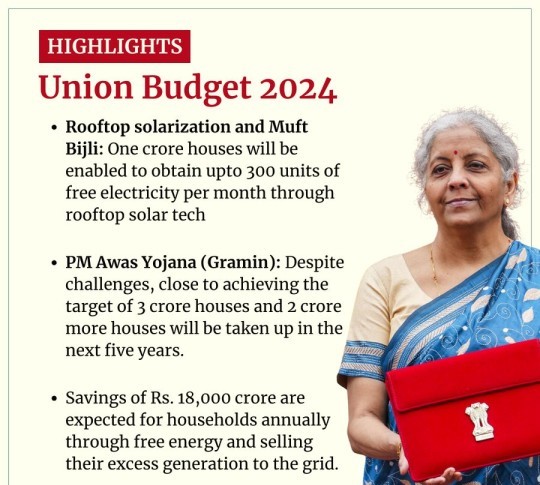

PM Awas Yojana (Gramin) – Despite challenges, implementation has continued, and we are close to achieving the target of 3 crore houses. An additional 2 crore houses will be undertaken in the next five years.

Rooftop solarization and free electricity – One crore houses will be enabled to receive up to 300 units of free electricity per month through rooftop solar technology.

Expected benefits include savings of up to Rs. 15,000 – Rs. 18,000 for households from free solar electricity and selling surplus to distribution company.

Housing for the middle class – A scheme will be launched to assist deserving sections of the middle class living in rented houses, slums, chawls, or unauthorized colonies to buy or build their own houses.

Medical colleges – The government plans to establish more medical colleges by utilizing existing hospital infrastructure. A committee will be set up to examine issues and make recommendations.

Maternal and Child healthcare – Various schemes will be consolidated under one comprehensive program. Upgradation of Anganwadi centers under Saksham Anganwadi and Poshan 2.0 will be expedited for improved nutrition delivery and early childhood care and development. The newly designed U-Win platform for managing immunization and intensified efforts of Mission Indradhanush will be rolled out.

Ayushman Bharat – Healthcare coverage will be extended to all Aasha, Anganwadi workers, and helpers.

Agriculture and Food Processing – Efforts in value addition and boosting farmers’ incomes will be increase. The PM Sampada Yojana has benefited 38 lakh farmers, while the PM Formalization of Micro Food Processing Enterprises has assisted 2.4 lakh SHGs.

February 01, 2024 11:32

Union Finance Minister Outlines Strategy for a Amrit Kaal, the Finance Minister focuses on the following areas:

Aatma Nirbhar Oilseeds Abhiyan – Expanding on the initiative announced in 2022, a plan will be devised to achieve self-reliance in oilseeds such as mustard, groundnut, soybean, sesame, and sunflower. This will involve research into high-yielding varieties, adoption of modern farming techniques, market connections, procurement, value addition, and crop insurance.

Dairy Development – A comprehensive program will be developed to support dairy farmers, with efforts underway to eradicate Foot and Mouth Disease. India is the world’s largest dairy producer but with low milk productivity.

Matsya Sampada – Recognizing the importance of assisting fishermen, our government established a separate fisheries department. Seafood exports have doubled since 2013-14. The implementation of the PM Matsya Sampada Yojana will be accelerated.

Lakhpati Didi – With 83 lakh self-help groups (SHGs) comprising 9 crore women, rural socio-economic dynamics are changing through empowerment and self-reliance. Their achievements will be acknowledged by honoring them. The target for such “Lakhpati Didis” will be increased from 2 crore to 3 crore.

Technological Advancements – A fund of Rs. 1 lakh crore will be established, offering 50-year interest-free loans for long-term financing or refinancing with extended tenures and low or zero interest rates. This will encourage the private sector to significantly expand Research and Innovation in emerging sectors. Additionally, a new scheme will be introduced to develop advanced technology for defense purposes.

February 01, 2024 11:39

Railway Developments

Three significant railway corridor projects are set to be initiated. These include:

- Energy, mineral, and cement corridor

- Port-connectivity corridor

- High-traffic density corridor

These initiatives aim to enhance logistics efficiency and reduce costs, as stated by Ms. Sitharaman. Additionally, they will contribute to improving safety for passenger trains.

Furthermore, Ms. Sitharaman mentions that 40,000 standard rail bogeys will be upgraded to Vande Bharat standards.

FEBRUARY 01, 2024 11:41

Green Energy

Finance Minister Nirmala Sitharaman revealed in Budget 2024 that the Government plans to offer viability gap funding for 1 GW of offshore wind energy. The nation aims to achieve a renewable energy capacity of 500 GW by 2030.

She mentioned that viability gap funding will also be extended for tapping into a 1 GW offshore wind energy capacity to work towards achieving net-zero emissions by 2070. Additionally, she stated that the Government stands prepared to aid States in accelerating the development of aspirational districts and blocks.

FEBRUARY 01, 2024 11:47

Reform in States for Vikasit Bharat Rs. 75,000 crore is being proposed as 50-year interest free loan for milestone-linked reforms by States.

February 01, 2024 11:49

Revised Estimates for 2023-24

The Revised Estimates (RE) for total receipts, excluding borrowings, amount to Rs. 27.56 lakh crores, with tax receipts accounting for Rs. 23.24 lakh crores. The Revised Estimates for total expenditure is Rs. 44.90 lakh crores. Revenue receipts are expected to reach Rs. 30.3 lakh crores, surpassing the Budget Estimates. The Revised Estimates for the fiscal deficit stands at 5.8% of GDP.

February 01, 2024 11:49

Budget Estimates for 2024-25

Total receipts, excluding borrowings, are projected to be Rs. 30.80 lakh crores. The total expenditure is estimated to be Rs. 47.66 lakh crores. Tax receipts are expected to amount to Rs. 26.02 lakh crores.

The scheme providing 50-year interest-free loans for capital expenditure to states will continue, with an allocation of Rs. 1.3 lakh crores. The fiscal deficit for 2024-25 is forecasted to be 5.1% of GDP, in line with the path of fiscal consolidation.

February 01, 2024 11:51

Tax Revisions

Ms. Sitharaman acknowledges the support of taxpayers and lists the recent changes in tax provisions.

Under the new tax scheme, individuals earning up to Rs. 7 lakh annually now have no tax liability. The threshold for presumptive taxation for retail businesses has been raised from Rs. 2 crore to Rs. 3 crore.

Corporate tax rates have been reduced from 30% to 22% for existing companies and to 15% for certain new manufacturing industries.

Filing tax returns has been streamlined and made more user-friendly. The average processing time for returns has been reduced from 93 days in 2013-14 to just 10 days, resulting in faster refunds, according to Ms. Sitharaman.

February 01, 2024 11:55

Tax Proposals

Regarding tax proposals, Ms. Sitharaman in Budget 2024 states that she does not intend to make any changes to taxation and suggests maintaining the current tax rates for both direct and indirect taxes, including import duties.

However, certain tax exemptions for startups and IFSC units are set to expire on March 31, 2023. To ensure continuity in taxation, Ms. Sitharaman proposes extending these exemptions until March 31, 2025.

February 01, 2024 11:57

Enhancing Taxpayer Services

In her address, Ms. Sitharaman highlights the need to enhance taxpayer services. She mentions the existence of numerous minor or contested direct tax demands, some dating as far back as 1962, causing distress to taxpayers.

Ms. Sitharaman proposes to withdraw such outstanding direct tax demands amounting up to Rs. 25,000 for years up to 2009-10 and Rs. 10,000 for the period from 2010 to 2015. This initiative is expected to benefit 1 crore taxpayers.

February 01, 2024 12:36

Government to Prioritize Cervical Cancer Vaccination

On February 1, Union Finance Minister Nirmala Sitharaman disclosed the government’s initiative to prioritize cervical cancer vaccination for girls aged 9 to 14 as part of her Interim Budget 2024.

FEBRUARY 01, 2024 13:13

PM Modi’ remarks following presentation of Interim Budget 2024. PM Modi said this budget is an inclusive and innovative budget which is confident about continuity.

February 01, 2024 13:20

PM Modi: This Budget 2024 Will Shape India’s Future

PM Modi expressed confidence that this budget 2024 will shape India’s future by empowering its four pillars: the youth, poor, women, and farmers. He emphasized that this budget is pivotal for India’s transformation and lays the groundwork for a ‘developed India by 2047’.

PM Modi highlighted two significant decisions in this interim budget. Firstly, the establishment of a Rs. 1 lakh crore corpus fund for research and innovation, and secondly, the tax exemptions provided to startups.

Additionally, he highlight the historic allocation of Rs. 11.11 lakh crore for capital expenditure, describing it as a “sweet spot” that will not only facilitate 21st-century infrastructure but also create numerous job opportunities for the youth.