How to Invest in Stock Market for Beginners in 2024?

Investing in the stock market can be an excellent way to grow your wealth over time. However, it can also be a bit tough for beginners, especially with the numerous options and complexities involved. To help you navigate the world of stock market investing, here’s a comprehensive guide how to invest in stock market for beginners:

Step 1: Understand the Basics of Investing

Before diving into the world of stocks, it’s crucial to grasp the fundamental concepts of investing. Familiarize yourself with the following terms:

- Stocks: These represent a share of ownership in a company. When you buy a stock, you become a part-owner of that company and are entitled to a portion of its profits.

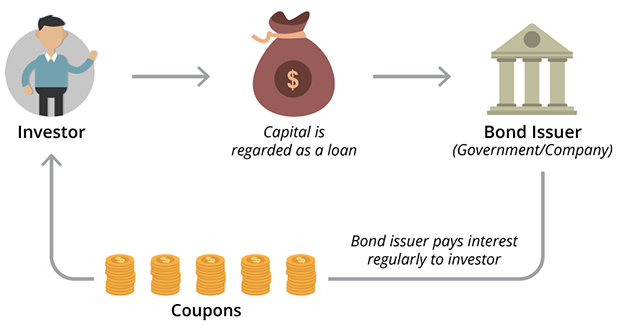

- Bonds: Bonds are essentially loans you provide to a company or government. In return, you receive regular interest payments and the principal amount back upon maturity.

- Mutual Funds: A Mutual Fund is a company that pools money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other assets. Mutual funds offer professional management and diversification benefits.

- ETFs (Exchange-Traded Funds): Similar to mutual funds, ETFs track specific market indexes or sectors, offering low fees and intraday trading capabilities.

Step 2: Evaluate Your Risk Tolerance

Investing involves varying degrees of risk. Your risk tolerance refers to your comfort level with potential losses. Before making any investment decisions, assess your risk tolerance honestly. Consider factors like your age, financial goals, and time horizon.

Step 3: Set Clear Financial Goals

Investing without clear goals is like travelling without a destination. Define your financial objectives, whether it’s saving for retirement, funding your child’s education, or building an emergency fund. Specific goals provide direction and motivation for your investment decisions.

Step 4: Choose a Reputable Brokerage Account

A brokerage account gives you a entry in the stock market. It allows you to buy, sell, and hold stocks, bonds, and other investment vehicles. Research and compare different brokerage firms, considering their fees, trading platforms, customer service, and overall reputation.

Step 5: Fund Your Brokerage Account

Once you’ve selected a brokerage firm, open an account and deposit funds into it. You can typically do this via bank transfer, check, or wire transfer. The minimum deposit amount varies depending on the broker.

Step 6: Conduct Thorough Research

Before investing in any specific stock, mutual fund, or ETF, conduct thorough research. Read financial reports, analyze company performance, and evaluate industry trends. Utilize online resources, financial publications, and expert opinions to make informed decisions.

Step 7: Start Small and Invest Regularly

Don’t feel pressured to invest large sums at once. Begin with smaller amounts and gradually increase your investments as your comfort level and financial situation allow. Consistent investing, even with modest amounts, can accumulate significant wealth over time.

Step 8: Diversify Your Portfolio

Diversification is a crucial risk management strategy. Avoid putting all your eggs in one basket. Spread your investments across different industries, asset classes, and risk levels to mitigate the impact of market fluctuations.

Step 9: Rebalance Your Portfolio Periodically

As your investments grow and market conditions change, it’s essential to rebalance your portfolio periodically. This involves adjusting the allocation of assets to maintain your desired risk profile and investment goals.

Step 10: Seek Professional Guidance if Needed

If you feel overwhelmed by the investment process or lack the time or expertise to manage your portfolio, consider seeking professional guidance from a qualified financial advisor. They can provide personalized advice and assist you in developing a sound investment strategy aligned with your goals and risk tolerance.

Remember, investing is a long-term efforts, and patience is key. Stay informed, make informed decisions, and avoid emotional investing. With discipline and a well-defined strategy, you can navigate the stock market and potentially achieve your financial aspirations.

FAQ:

- What is the Stock Market and How Does It Work?

- Understanding the basics of stock markets and their functioning.

- Why Should I Consider Investing in Stocks?

- Exploring the potential benefits and reasons for including stocks in your investment portfolio.

- How Much Money Do I Need to Start Investing in Stocks?

- Discussing the minimum investment required and strategies for getting started with different budget levels.

- What Are the Different Types of Stocks?

- Providing insights into common stock categories, such as growth stocks, value stocks, and dividend stocks.

- How Do I Choose Which Stocks to Invest In?

- Tips and methods for researching and selecting stocks that align with your investment goals.

- What Is Diversification and Why Is It Important?

- Understanding the concept of diversification and its role in managing risk in your investment portfolio.

- How Do I Open a Brokerage Account?

- Step-by-step guidance on setting up a brokerage account to start buying and selling stocks.

- What Are the Risks Associated with Stock Market Investing?

- Identifying and managing risks, including market volatility and potential losses.

- Should I Invest for the Short Term or Long Term?

- Exploring the differences between short-term and long-term investing and considerations for each approach.

- What is Dollar-Cost Averaging, and How Does It Work?

- Understanding the concept of dollar-cost averaging and how it can be a strategic approach for long-term investors.

- How Do Economic Factors Affect the Stock Market?

- Explaining the influence of economic indicators on stock prices and overall market trends.

- What Resources Can I Use to Stay Informed About the Stock Market?

- Listing reliable sources for market news, financial analysis, and tools to stay updated on your investments.

Remember, these answers are just starting points, and it’s crucial to conduct further research and, if necessary, seek advice from financial professionals before making investment decisions.