Sovereign Gold Bonds 2023-24 Series IV Commences on February 12: Discover the Latest Issue Price for this SGB Tranche

The upcoming Series IV of Sovereign Gold Bonds 2023–24 will be available for subscription starting from February 12, 2024. These bonds are issued by the Reserve Bank on behalf of the Government of India.

The price of the Sovereign Gold Bonds 2023-24 Series IV issuance stands at Rs 6,263. If payment is made online, a deduction of Rs 50 will be applied, making the issue price Rs 6,213.

According to a Reserve Bank press release dated February 9, 2024, and Government of India Notification F.No.4(6)-B(W&M)/2023, the Sovereign Gold Bond Scheme 2023-24 – Series IV will be open for subscription from February 12 to February 16, 2024. The bond’s nominal value, calculated based on the average closing price of gold (999 purity) published by the India Bullion and Jewellers Association Ltd (IBJA) for the last three working days preceding the subscription period (February 07, February 08, and February 09, 2024), is Rs 6,263 per gram. The Government of India, in collaboration with the Reserve Bank, has decided to provide a discount of Rs 50 per gram to investors who apply online and make payments digitally. Hence, for such investors, the issue price of the Gold Bond will be Rs 6,213 per gram.

Sovereign Gold Bonds 2023-24 Series IV

Subscription Period: February 12 – February 16, 2024 Issuance Date: February 21, 2024 As per HDFC Bank, “The prices of SGBs are correlated with the rates of 999 purity (24k) gold, as published by the India Bullion and Jewellers Association (IBJA). Given its liquidity, investors have the flexibility to easily sell SGBs in the secondary market whenever gold prices surge.”

Sovereign Gold Bonds(SGB) 2023-24 Series IV Settlement Date

The settlement date for SGB 2023-24 Series IV is February 21, 2024.

Sovereign Gold Bonds 2023-24 Discount

The Reserve Bank of India (RBI) grants a Rs 50 discount to investors who opt for online registration and digital payment. Consequently, the issue price of gold bonds for these investors would be Rs 6,213 per unit, equivalent to one gram of gold.

Sovereign Gold Bonds 2023-24 Interest Rate

Investors receive a fixed interest rate of 2.5% per annum for the current series, paid semi-annually on the nominal value. The fixed interest earned remains unchanged by the capital appreciation of Gold Bonds.

Advantages of Sovereign Gold Bond Schemes The HDFC Bank website outlines the following benefits of SGB:

- Attractive Interest with Asset Appreciation Opportunity (2.5%)

- Redemption Linked to Gold Price

- Elimination of Risk and Cost of Storage

- Exemption from Capital Gains Tax if Held until Maturity

- Hassle-free: Ownership of Gold without Physical Possession (No Risks and No Storage Costs)

- Tax Treatment: Capital Gains Tax on Redemption of SGB for individuals is Exempted. Indexation Benefits Provided for Long-Term Capital Gains upon Bond Transfer.

- Tradability: Bonds Will Be Tradable on Stock Exchanges within a Fortnight of Issuance on a Date Notified by the RBI.

- Transferability: Bonds Can Be Transferred via Execution of an Instrument of Transfer in Accordance with the Provisions of the Government Securities Act.

Sovereign Gold Bonds 2023-24 Specifications

The tenure of the Bond spans 8 years with an exit option available in the 5th year, to be exercised on interest payment dates. These Gold Bonds will be issued as Government of India Stocks under the GS Act, 2006. Investors will receive a Holding Certificate for the same, and the Bonds are eligible for conversion into demat form.

The sale of Bonds will be facilitated through banks, the Stock Holding Corporation of India Limited (SHCIL), designated post offices as notified, and recognized stock exchanges, namely the National Stock Exchange of India Ltd and Bombay Stock Exchange Ltd, either directly or through agents.

FAQs

Q: When does the Sovereign Gold Bonds 2023-24 Series IV commence?

A: The Series IV of Sovereign Gold Bonds 2023-24 commences on February 12.

Q: What is the latest issue price for this SGB?

A: The latest issue price for the Sovereign Gold Bonds 2023-24 Series IV is typically announced by the Reserve Bank of India (RBI) at the time of commencement.

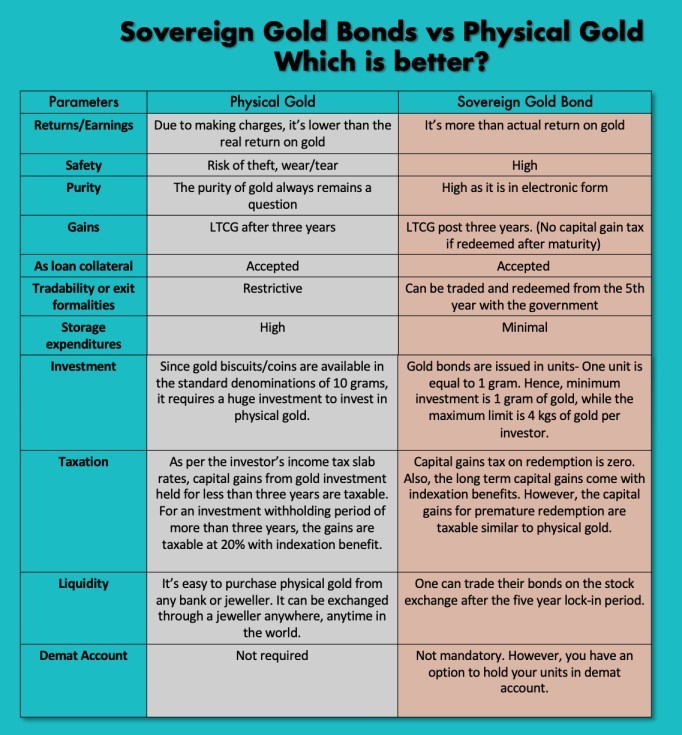

Q: How are Sovereign Gold Bonds different from physical gold?

A: Sovereign Gold Bonds are government securities denominated in grams of gold. They offer a safer and more convenient alternative to owning physical gold as they eliminate storage and security concerns. Additionally, they earn interest, which is not the case with physical gold.

Q: Can I trade Sovereign Gold Bonds in the secondary market?

A: Yes, Sovereign Gold Bonds can be traded on stock exchanges within the stipulated time frame after their issuance. However, liquidity may vary depending on market conditions.

Q: What are the benefits of investing in Sovereign Gold Bonds?

A: Some benefits of investing in Sovereign Gold Bonds include earning interest at a fixed rate, exemption from capital gains tax upon redemption, and the assurance of purity since they are issued by the government.

Q: What is the maturity period for Sovereign Gold Bonds?

A: The maturity period for Sovereign Gold Bonds is typically 8 years. However, investors have the option to exit after the fifth year, on the interest payment dates.

Q: How can I subscribe to Sovereign Gold Bonds?

A: Investors can subscribe to Sovereign Gold Bonds through scheduled commercial banks, designated post offices, Stock Holding Corporation of India Ltd. (SHCIL), and recognized stock exchanges either directly or through agents.

READ MORE : RBI Policy: Das Says Rate Stance Clear, but Transmission Incomplete