Secure Her Future: The Easy Guide to Sukanya Samriddhi Yojana

Investing in a secure future for your daughter is a crucial step toward ensuring her financial independence and empowerment. One such avenue that has gained prominence in recent years is the Sukanya Samriddhi Yojana. Let’s dive into the details of this scheme and understand how it can be the key to securing your daughter’s future.

Introduction to Sukanya Samriddhi Yojana

In an effort to secure the future of their loved ones, especially their daughters, the Government of India launched a transformational savings scheme known as Sukanya Samriddhi Yojana. Launched with the primary objective of nurturing the financial well-being of the girl child, the scheme has received wide appreciation for its unique features and long-term benefits.

Sukanya Samriddhi Yojana is a dedicated savings scheme that recognizes the importance of financial planning from an early age. This initiative not only encourages parents to invest in their daughter’s future but also serves as a tool to empower girls. As we delve into the intricacies of this scheme, it becomes clear that Sukanya Samriddhi Yojana goes beyond the traditional savings approach, offering a comprehensive and tailored solution to secure one’s financial freedom.

The next sections of this article will highlight the eligibility criteria, features, benefits and step-by-step process of opening an account under Sukanya Samriddhi Yojana. Understanding this scheme is not just a financial decision but a commitment to provide a solid foundation for the dreams and aspirations of the next generation of empowered women.

Understanding Sukanya Samriddhi Yojana

Eligibility Criteria

To participate in Sukanya Samriddhi Yojana and pave the way for a secure financial future for your daughter, it is important to fulfill the specific eligibility criteria outlined by the government. Here are the details of the key necessities:

- Age of the girl:

Sukanya Samriddhi Yojana is designed for girls and the account can be opened only if the girl is below 10 years of age. This age restriction ensures that parents can start saving early, leading to maximum benefits in the long run. - Parent or guardian as account holder:

The account can be opened by parents or legal guardian on behalf of the girl child. This ensures that the responsible person manages the financial aspects of the account until the girl reaches adulthood. - Citizenship:

Sukanya Samriddhi Yojana is available to residents of India. It is important to provide proof of residence, such as proof of address, during the account opening process. - Number of Accounts:

It is important to note that the scheme allows opening of only one Sukanya Samriddhi account for a single girl child. In case of multiple daughters, separate accounts can be opened for each, but the cumulative deposits must adhere to the specified limit.

Fulfilling these eligibility criteria ensures that you can avail the full benefits of Sukanya Samriddhi Yojana while creating a financial safety net for your daughter’s future endeavours. As you consider embarking on this journey, verify that you meet these requirements to seamlessly begin the account opening process.

Account Opening Process

Opening a Sukanya Samriddhi Yojana account is a straightforward process, designed to create hassle-free financial planning for your daughter’s future. Follow these step-by-step guidelines to open an account:

- Visit designated post offices or banks:

To start the process, visit any post office or bank authorized to offer Sukanya Samriddhi Yojana accounts. The list of authorized banks may vary, so check with your local financial institutions. - Collect Account Opening Form:

Request Sukanya Samriddhi Yojana account opening form from the concerned post office or bank. Make sure you fill out the form with accurate and updated information. - Provide the required documents:

Along with the filled application form, submit the required documents, including:

Birth certificate of the girl child.

Identity proof of parent/guardian (Aadhar Card, Passport, or Voter ID Card).

Proof of address (utility bill or rental agreement).

Passport size photographs of the girl child and parents/guardian. - Deposit the initial amount:

Pay the initial deposit. Minimum deposit amounts vary and are subject to change based on government regulations. Make sure you are aware of the current minimum deposit requirement. - Complete the KYC Process:

Fulfill Know Your Customer (KYC) requirements mandated by the bank or post office. This may include providing additional documents or details to verify the identity of the account holder. - Get Passbook:

Once the account is successfully opened a passbook will be issued. The passbook contains details of the account, including transactions, deposits and interest earned. Make sure you review entries carefully for accuracy. - Contribute Regularly:

Commit to making regular contributions to Sukanya Samriddhi Account. This plan allows flexible contribution options, but it is advisable to follow the savings plan consistently for optimal results. - Monitor Account Online (Optional):

Many banks provide online access to Sukanya Samriddhi accounts. Consider activating online services to monitor accounts, check balances, and easily keep track of interest income.

Features and Benefits

High Interest Rates

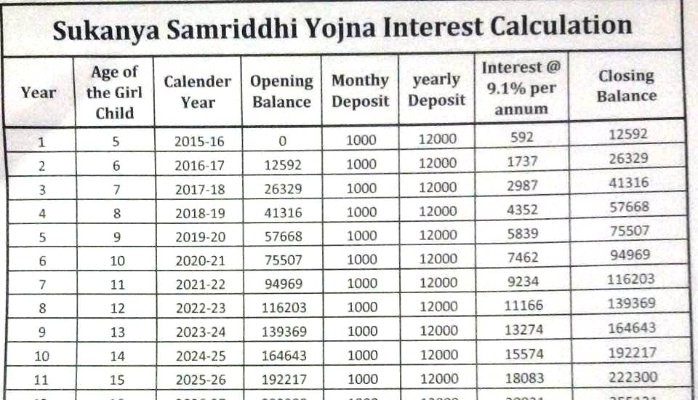

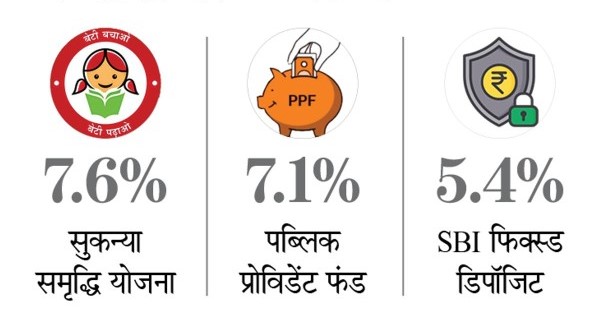

One of the key features that makes Sukanya Samriddhi Yojana an attractive savings option is its high interest rates. This scheme provides an excellent opportunity to accumulate substantial wealth over time. Let us look at the specifics of interest rates related to Sukanya Samriddhi Yojana:

1. Fixed and Compound Interest:

Sukanya Samriddhi Yojana offers a fixed interest rate which is compounded annually. This compounding feature ensures that the interest earned in one year contributes to the principal amount in the next year, leading to accelerated growth in the long run.

2. Attractive Annual Interest Rates:

The interest rates for Sukanya Samriddhi Yojana are declared by the government and are usually higher than the interest rates offered by traditional savings accounts. The rates are subject to revision from time to time, but historically, they have been competitive, making the scheme an attractive option for investors.

3. Assured Income on Principal:

The interest earned is calculated on the account balance and is credited to the account annually. This ensures that the interest becomes part of the principal, contributing to higher earnings in later years.

4. Compound Benefits in the Long Term:

The compounding effect of interest rates greatly benefits those who start investing early in a girl’s life. By reinvesting the interest earned, the net worth grows exponentially, providing adequate funds for major life events like education or marriage.

5. Periodic Rate Announcements:

The government reviews and announces interest rates from time to time. Although the rates are fixed for a financial year, there are changes depending on the economic conditions. It is important to stay informed about these periodic announcements to maximize the benefits of Sukanya Samriddhi Yojana.

6. Tax-free interest income:

Another noteworthy aspect is that the interest earned under Sukanya Samriddhi Yojana is completely tax-free. This tax exemption adds to the total returns, making the effective yield even more attractive for investors.

7. Comparison with other savings options:

Compared to traditional savings plans, the higher interest rates of Sukanya Samriddhi Yojana make it a better option for those who want to build a significant corpus for specific financial goals.

Tax Benefits

Sukanya Samriddhi Yojana is not only known for its high interest rates but also offers attractive tax benefits, making it a perfect financial instrument to secure the future of the girl child. Understanding these tax benefits adds another layer of attraction to a government-backed savings scheme:

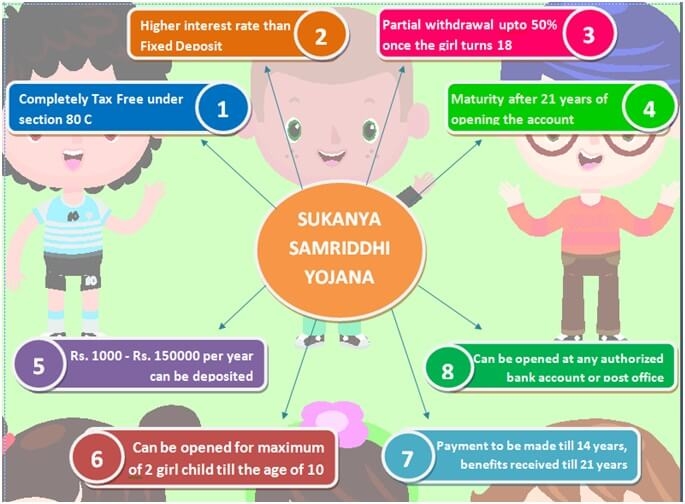

1. Exemption under Section 80C:

Contributions made to Sukanya Samriddhi Yojana are eligible for tax benefits under Section 80C of the Income Tax Act. Deduction can be claimed from the total taxable income on the amount invested up to a specified limit.

2. Maximum deduction limit:

The maximum limit for claiming deduction under Section 80C is subject to change as per government notification. It is important to stay updated about the current limitations to maximize tax benefits.

3. Tax-free interest income:

The interest earned on Sukanya Samriddhi Yojana account is completely tax-free. This includes the annually compounded interest as well as the maturity amount. This tax exemption increases the effective return on investment.

4. Double benefit for parents:

Parents or legal guardians who contribute to Sukanya Samriddhi Account not only secure the financial future of the girl child but also enjoy tax benefits. The dual benefit of wealth creation and tax saving makes this scheme particularly attractive.

5. Applicability of tax benefits:

Tax benefits are applicable for each financial year in which the contribution is made. As long as the investment falls within the specified limit, the parent can continue to claim the deduction till the maturity of the plan.

6. Withdrawal discount:

When the girl child reaches the age of maturity and decides to withdraw the accumulated money, the amount received including interest remains free from taxation. This ensures that the entire fund serves its intended purpose without any tax implications.

7. Strategic Tax Planning for Parents:

Sukanya Samriddhi Yojana provides parents with an opportunity for strategic tax planning. By combining contributions with their overall tax-saving strategy, parents can optimize their financial portfolio while securing their daughter’s future.

8. Documentation for Tax Filing:

To avail tax benefits, it is necessary to maintain proper documents including Sukanya Samriddhi passbook and contribution receipts. These documents serve as evidence when applying for tax deduction.

In short, the tax benefits associated with Sukanya Samriddhi Yojana make it a prudent choice for parents seeking not only wealth creation but also effective tax planning. By availing these benefits, families can align their financial goals with the broader objective of securing the future of the girl child.

Lock-in Period

Sukanya Samriddhi Yojana is not only known for its high interest rates but also offers attractive tax benefits, making it a perfect financial instrument to secure the future of the girl child. Understanding these tax benefits adds another layer of attraction to a government-backed savings scheme:

1. Exemption under Section 80C:

Contributions made to Sukanya Samriddhi Yojana are eligible for tax benefits under Section 80C of the Income Tax Act. Deduction can be claimed from the total taxable income on the amount invested up to a specified limit.

2. Maximum deduction limit:

The maximum limit for claiming deduction under Section 80C is subject to change as per government notification. It is important to stay updated about the current limitations to maximize tax benefits.

3. Tax-free interest income:

The interest earned on Sukanya Samriddhi Yojana account is completely tax-free. This includes the annually compounded interest as well as the maturity amount. This tax exemption increases the effective return on investment.

4. Double benefit for parents:

Parents or legal guardians who contribute to Sukanya Samriddhi Account not only secure the financial future of the girl child but also enjoy tax benefits. The dual benefit of wealth creation and tax saving makes this scheme particularly attractive.

5. Applicability of tax benefits:

Tax benefits are applicable for each financial year in which the contribution is made. As long as the investment falls within the specified limit, the parent can continue to claim the deduction till the maturity of the plan.

6. Withdrawal discount:

When the girl child reaches the age of maturity and decides to withdraw the accumulated money, the amount received including interest remains free from taxation. This ensures that the entire fund serves its intended purpose without any tax implications.

7. Strategic Tax Planning for Parents:

Sukanya Samriddhi Yojana provides parents with an opportunity for strategic tax planning. By combining contributions with their overall tax-saving strategy, parents can optimize their financial portfolio while securing their daughter’s future.

8. Documentation for Tax Filing:

To avail tax benefits, it is necessary to maintain proper documents including Sukanya Samriddhi passbook and contribution receipts. These documents serve as evidence when applying for tax deduction.

Monitoring and Managing the Account

Ensuring effective management and regular monitoring of Sukanya Samriddhi Yojana account is integral to maximizing its benefits and achieving desired financial goals. Here’s a comprehensive guide on how to efficiently monitor and manage the account:

1. Online Account Access:

Many banks and post offices provide online access to Sukanya Samriddhi Yojana accounts. Avail this facility by registering for online services. It provides a convenient way to monitor your account, check balances and track transactions from the comfort of your home.

2. Check passbook regularly:

For those who prefer traditional methods, the passbook issued by the bank or post office remains an important tool for account monitoring. Update the passbook regularly to review entries including deposits, interest earned and any partial withdrawals.

3. Stay informed about interest rates:

Keep yourself informed about any changes in interest rates announced by the government. Adjustments may occur from time to time, which may affect the total return on investment. Stay updated to make informed decisions regarding the account.

4. Set reminders for deposits:

Since Sukanya Samriddhi Yojana encourages frequent savings, set reminders for regular deposits. Timely contributions ensure that the account continues to grow, and you don’t miss out on any potential interest accumulation.

5. Use the online calculator:

Specific online calculators for Sukanya Samriddhi Yojana are available to estimate the future maturity amount and interest income based on different contribution scenarios. These calculators provide information on the impact of different savings patterns.

6. Monitor partial withdrawals:

If the girl turns 18, be alert about possible educational or marriage expenses that may require partial withdrawal. Understand the documentation requirements for such withdrawals and plan accordingly.

7. Review Account Details:

Request and review account statements from the bank or post office from time to time. Statements provide a comprehensive overview of account performance, helping you track its growth and identify any anomalies.

8. Consider increasing contributions:

Regularly assess your financial situation and consider increasing contributions if possible. Higher contribution increases interest income, which accelerates the growth of Sukanya Samriddhi Yojana fund.

9. Seek professional advice if needed:

If you have any questions or need clarification on any aspect of the Sukanya Samriddhi Yojana, consider seeking advice from financial professionals or contacting the bank’s customer service. Clarity ensures effective account management.

10. Review the tax implications:

Understand the tax implications associated with Sukanya Samriddhi Yojana, especially during the withdrawal phase. Stay informed about any changes in tax laws that may affect the tax-free status of contributions and interest income.

Efficient monitoring and management of Sukanya Samriddhi Yojana account significantly contributes to its success in securing the financial future of the girl child. By being proactive and informed, you can understand the intricacies of the plan and optimize its benefits for long-term wealth creation.

Comparison with Other Investment Options

When it comes to securing your daughter’s financial future, many investment options attract attention. However, Sukanya Samriddhi Yojana stands out in the range of options, offering unique features and benefits that set it apart. Let us know how Sukanya Samriddhi Yojana compares with other investment vehicles:

1. Attractive Interest Rates:

Sukanya Samriddhi Yojana boasts of high and compound interest rates. Compared to traditional savings accounts, fixed deposits or even some mutual funds, this scheme offers more competitive returns in the long run.

2. Tax benefits:

One of the extraordinary benefits of Sukanya Samriddhi Yojana is its eligibility for tax benefits. Contributions, interest earned and maturity amount are all exempt from income tax under section 80C. This tax benefit gives it an edge over many other investment options.

3. Focus on the girl child:

Unlike normal investment schemes, Sukanya Samriddhi Yojana is specially designed for the welfare of the girl child. This targeted approach ensures that the accumulated wealth is dedicated to his education, marriage, or other important life events.

4. Disciplined savings with lock-in period:

The lock-in period of Sukanya Samriddhi Yojana encourages disciplined savings, while restricting immediate access. This feature ensures that the funds remain dedicated to the future of the girl child and are not vulnerable to impulsive withdrawals.

5. Government Backed Security:

Sukanya Samriddhi Yojana is a government-backed savings scheme, which offers a high level of protection. This assurance of government support increases the credibility of the scheme compared to some market-dependent investments.

6. Flexible Contribution Options:

The scheme allows flexible contribution options, allowing parents or guardians to align their savings with their financial capacity. This flexibility is a notable advantage compared to the rigid contribution structures in other investment avenues.

7. Compound effect:

The compounding effect of interest in Sukanya Samriddhi Yojana is a powerful wealth-building factor. Over time, reinvestment of interest grows exponentially, outperforming many investment options that cannot provide the same compounding benefits.

8. No Market Dependence:

Unlike mutual funds or stock market investments, Sukanya Samriddhi Yojana is not subject to market volatility. Returns are determined by fixed interest rates, providing a more stable and predictable growth path.

9. Targeted for empowerment:

Sukanya Samriddhi Yojana goes beyond financial benefits; It contributes to the empowerment of girls. By earmarking funds for her education and marriage, the plan aligns with broader societal goals of promoting gender equality and empowerment.

10. Long Term Perspective:

With the maturity period extended till the girl turns 21, Sukanya Samriddhi Yojana aligns with long-term financial planning. This extended approach differentiates it from short-term investment options that may not provide comparable returns over extended periods.

Ensuring a Bright Future

Investing in Sukanya Samriddhi Yojana is not just a financial decision; This is a commitment to ensure a bright and strong future for your daughter. Let us see how the scheme goes beyond monetary benefits and plays a vital role in shaping positive trajectories for the girl child:

1. Linking financial security to empowerment:

Sukanya Samriddhi Yojana acts as a bridge between financial security and empowerment of the girl child. By creating a dedicated fund for her future endeavours, the plan facilitates choices that empower her education, career and personal aspirations.

2. Supporting educational aspirations:

The funds collected through Sukanya Samriddhi Yojana can be strategically used to support the educational activities of the girl child. Be it higher education within the country or pursuing educational goals abroad, this scheme acts as a reliable financial backbone.

3. Breaking down barriers to education:

In many cases, financial constraints become a hindrance to girls’ education. Sukanya Samriddhi Yojana aims to break these barriers by providing a dedicated fund that ensures that educational expenses are not a barrier, thereby opening up a world of opportunities.

4. Encouraging Career Aspirations:

A secure financial base allows girl children to explore and pursue their career aspirations without the burden of financial constraints. Sukanya Samriddhi Yojana encourages the development of skills and talent, paving the way for a fulfilling professional journey.

5. Promoting Financial Freedom:

Beyond traditional gender roles, Sukanya Samriddhi Yojana promotes the idea of financial independence for the girl child. The accumulated funds can be helpful in supporting her entrepreneurial ventures, thereby enabling her to contribute meaningfully to society.

6. Promoting gender equality:

By specifically addressing the financial needs of the girl child, Sukanya Samriddhi Yojana contributes to the broader goal of gender equality. This sends a powerful message that financial planning is not gender-biased and every child, regardless of gender, deserves an equal opportunity for a bright future.

7. Encouraging long term planning:

The extended maturity period of Sukanya Samriddhi Yojana encourages parents to plan long term for their daughter’s future. This strategic approach allows gradual achievement of educational and career goals without compromising financial stability.

8. Building a Legacy of Empowerment:

Choosing Sukanya Samriddhi Yojana is not just an investment in the present; This is a commitment to create a legacy of empowerment. The positive impact on girls’ lives resonates across generations, inspiring a culture of financial prudence and empowerment.

9. Creating opportunities for skill development:

The financial assistance provided by Sukanya Samriddhi Yojana extends to skill development opportunities. Be it additional courses, workshops or vocational training, the scheme acts as a catalyst for the holistic development of the girl child.

10. Enhancing Life Choices:

Ultimately, Sukanya Samriddhi Yojana enhances the life choices available to the girl child. This enables him to take decisions based on passion, merit and personal fulfillment rather than being bound by financial limitations.

Conclusion

In the journey of parenting, where every decision shapes the future of our children, choosing Sukanya Samriddhi Yojana is a testament to foresight and commitment. This government-backed savings scheme goes beyond the scope of financial planning; It becomes a symbol of empowerment, education and unlimited opportunities for the girl child.

As we deal with the complexities of modern life, Sukanya Samriddhi Yojana emerges as a trusted partner, ensuring a brighter tomorrow. The plan’s emphasis on a secure financial foundation matches seamlessly with the aspirations of parents for their daughters. Beyond numbers and interest rates, it encapsulates a vision of a future where dreams are nurtured and obstacles are turned into stepping stones.

The journey with Sukanya Samriddhi Yojana is not just about accumulating wealth; This is a strategic investment in the education, career aspirations and overall empowerment of the girl child. High interest rates, tax benefits and disciplined savings foster an environment where financial constraints do not become obstacles, and ambitions can flourish without hindrance.

Furthermore, Sukanya Samriddhi Yojana is a catalyst for change in social norms. By meeting the financial needs of girls in particular, it contributes to breaking down gender barriers and promotes a vision of equal opportunities. This is not just an account; It’s a legacy-building tool that resonates across generations, creating a culture where financial prudence meets empowerment.

Finally, as you embark on this journey with Sukanya Samriddhi Yojana, remember that you are not just securing your daughter’s future; You are shaping a story of resilience, empowerment, and limitless potential. This plan is more than an investment; It is a commitment to a future where every girl can dream big, achieve her goals and be a beacon of inspiration for generations to come.

In a world where financial decisions resonate with time, Sukanya Samriddhi Yojana stands as a testament to the belief that a secure tomorrow begins with wise choices today.

Frequently Asked Questions

- Who can open a Sukanya Samriddhi account?

- Any parent or legal guardian on behalf of a girl child below 10 years of age.

- What are the tax benefits associated with Sukanya Samriddhi Yojana?

- Contributions, interest earned, and maturity amount are all eligible for tax benefits under Section 80C.

- Can I withdraw money from the account before the maturity period?

- Partial withdrawals are allowed under specific conditions, such as for the girl child’s education or marriage.

- How is the interest calculated in Sukanya Samriddhi Yojana?

- The interest is compounded annually, and the formula used ensures significant growth over time.

- Is there any government support for this scheme?

- Yes, the government actively promotes and supports Sukanya Samriddhi Yojana as part of its initiatives for the girl child’s welfare.